What Are Voluntary Benefits? Meaning, Types & Importance in India

Book a Free DemoVoluntary Benefits

Optional perks employees can choose to purchase or enroll in, such as supplemental insurance or wellness programs. Voluntary benefits enhance total rewards offerings.

Voluntary benefits are optional perks offered by employers that employees can choose to purchase or enrol in, usually at discounted group rates. They are designed to enhance the overall compensation package without significantly increasing employer costs.

In India, voluntary benefits often include supplemental health insurance, life insurance, wellness programs, and lifestyle perks like gym memberships or meal vouchers. These benefits provide flexibility, allowing employees to customise their rewards based on personal needs and preferences.

💬 “After adding voluntary benefits like wellness programs, our employee satisfaction scores improved by 22%.” — Priya, HR Benefits Manager

Common Types of Voluntary Benefits

| Type | Description |

| Supplemental Health Insurance | Extra medical cover beyond the employer’s main policy |

| Life & Accident Insurance | Financial protection for employees and their families |

| Wellness Programs | Gym memberships, mental health counselling, yoga sessions |

| Lifestyle Perks | Meal vouchers, travel discounts, subscription services |

| Financial Benefits | Loan assistance, retirement savings plans |

Bonus: In India, offering voluntary benefits can improve retention and attract top talent, especially in competitive job markets.

Why It Matters

- Increases employee satisfaction and engagement

- Provides flexibility for diverse workforce needs

- Enhances employer brand in talent markets

- Offers cost-effective perks for companies

- Supports employee well-being and work-life balance

Common Tools for Managing Voluntary Benefits in India

- Benefits management platforms: Pazcare, Plum, Loop

- HRMS with integrated benefits modules

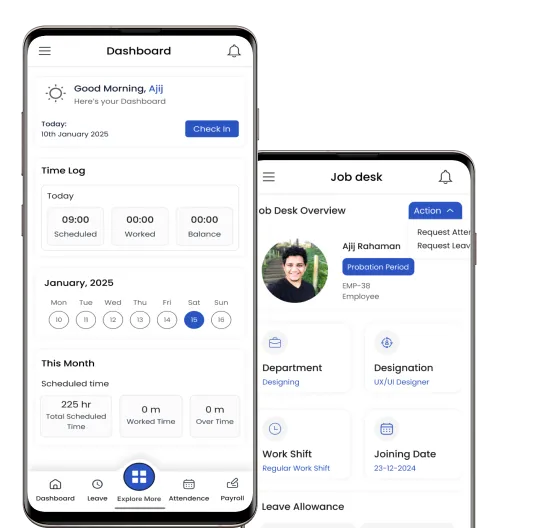

- Pagarai HR Suite – for benefit selection, enrolment, and tracking

How Pagarai Helps

- Curates a range of voluntary benefit options for employees

- Manages enrolment and payroll deductions seamlessly

- Tracks benefit usage and employee preferences

- Integrates benefits data with performance and retention analytics

- Ensures compliance with taxation rules for employee perks

FAQ

Q1: Are voluntary benefits taxable in India?

Some are — for example, certain allowances may be taxable, while insurance benefits may not be.

Q2: Do employers have to pay for voluntary benefits?

Not necessarily — employees often bear the cost, but employers may subsidise it.

Q3: Can voluntary benefits be customised?

Yes — employees can choose benefits that suit their needs.

Q4: Are voluntary benefits common in Indian startups?

Increasingly yes, especially in tech, fintech, and wellness-focused companies.