What Are Unemployment Benefits? Meaning, Eligibility & Rules in India

Book a Free DemoUnemployment Benefits

Financial assistance provided to individuals who have lost their jobs through no fault of their own. These benefits offer temporary income support while job hunting.

Unemployment benefits are financial assistance provided to individuals who have lost their jobs through no fault of their own. These benefits offer temporary income support to help workers cover basic expenses while they search for new employment.

In India, unemployment benefits are primarily available through the Employees’ State Insurance (ESI) Corporation’s Rajiv Gandhi Shramik Kalyan Yojana and the Atal Beemit Vyakti Kalyan Yojana. These schemes cater to eligible workers covered under ESI, providing relief during periods of involuntary job loss.

💬 “With Pagarai’s HR compliance tracker, we ensured our employees could access unemployment benefits without delays.” — Vivek, Payroll & Compliance Manager

👉 Want to simplify employee benefits compliance? [Get Pagarai’s HR compliance toolkit →]

Key Features of Unemployment Benefits in India

| Feature | Description |

| Eligibility | Applies to insured workers under ESI who lose jobs involuntarily |

| Duration | Benefits usually provided for up to 24 months in a lifetime |

| Benefit Amount | Paid as a percentage of last drawn wages |

| Application Process | Claims filed via ESI regional offices or online portals |

Bonus: Many private companies in India supplement government benefits with severance pay or extended insurance coverage.

Why It Matters

- Provides financial stability during job loss

- Encourages formal employment with ESI coverage

- Reduces the immediate economic burden on families

- Supports workforce resilience during layoffs or closures

- Demonstrates employer commitment to employee welfare

Common Tools for Managing Unemployment Benefits in India

- ESI online portal for benefit claims

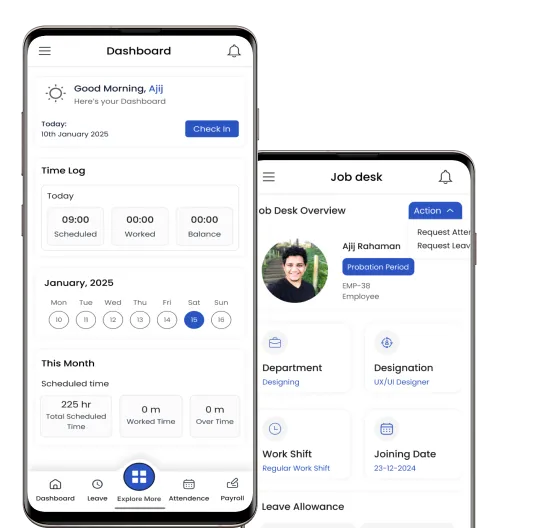

- HR compliance management systems

- Pagarai HR Suite – for benefits eligibility tracking and documentation management

How Pagarai Helps

- Tracks employee ESI eligibility and contributions

- Guides HR teams in filing unemployment benefit claims

- Maintains compliance records for audits

- Integrates severance and government benefits in final settlements

- Provides employee communication templates for benefit claims

FAQ

Q1: Are unemployment benefits taxable in India?

No — benefits under ESI unemployment schemes are generally tax-exempt.

Q2: Can contract employees get unemployment benefits?

Only if they are covered under ESI and meet eligibility requirements.

Q3: How long does it take to receive unemployment benefits?

Processing may take 30–60 days, depending on documentation and approval speed.

Q4: Do all Indian employees get unemployment benefits?

No — only eligible insured workers under ESI schemes qualify.