What Are Statutory Benefits? Meaning, List & Compliance Rules in India

Book a Free DemoStatutory Benefits

Mandatory employee benefits required by law, such as social security, health insurance, or paid leave. Compliance with statutory benefits is essential for legal operation.

Statutory benefits are employee benefits mandated by Indian labour laws. Employers are legally required to provide these benefits to ensure employee welfare, financial security, and workplace fairness. Non-compliance can result in penalties, legal action, and reputational damage.

In India, statutory benefits vary based on company size, employee wages, and state-specific labour regulations. They include provisions such as Provident Fund (PF), Employee State Insurance (ESI), gratuity, and paid leave entitlements.

💬 “Pagarai’s compliance dashboard helped us stay updated with all statutory benefit requirements and avoid penalties.” — Ananya, HR Compliance Officer

👉 Want to automate statutory compliance? [Get Pagarai’s statutory benefits checklist →]

Key Statutory Benefits in India

| Benefit | Law / Regulation | Purpose |

| Provident Fund (PF) | Employees’ Provident Funds and Miscellaneous Provisions Act, 1952 | Retirement savings for employees |

| Employee State Insurance (ESI) | Employees’ State Insurance Act, 1948 | Medical coverage for employees and dependents |

| Gratuity | Payment of Gratuity Act, 1972 | Lump sum payment at retirement/resignation after 5 years of service |

| Maternity Benefit | Maternity Benefit Act, 1961 | Paid leave for female employees during maternity |

| Paid Leave | State Shops and Establishments Acts | Leave entitlements for health, rest, and personal reasons |

Bonus: Keep track of periodic changes in thresholds and contribution rates to stay compliant.

Why It Matters

- Ensures compliance with Indian labour laws

- Protects employee rights and welfare

- Reduces legal and financial risks for employers

- Builds trust and improves employee retention

- Enhances employer branding and reputation

Common Tools for Managing Statutory Benefits in India

- GreytHR, Keka – for payroll and statutory compliance automation

- Government portals like EPFO & ESIC – for filing and reporting

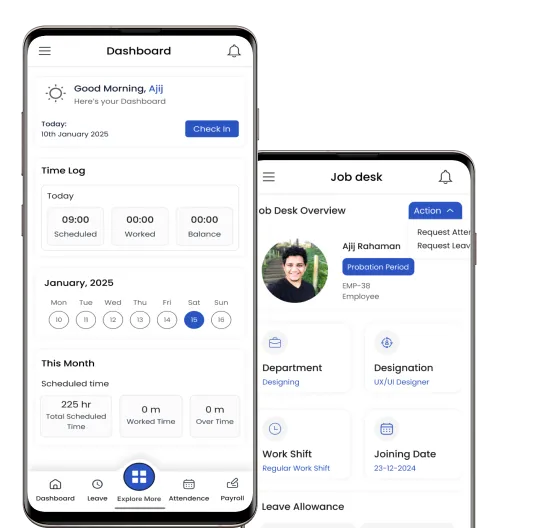

- Pagarai HR Suite – for integrated statutory benefits tracking and reporting

How Pagarai Helps

- Maintains updated statutory benefits compliance checklists

- Automates PF, ESI, and gratuity calculations

- Integrates benefits processing with payroll

- Generates statutory reports for audits

- Sends alerts for legal updates and deadlines

FAQ

Q1: Are statutory benefits mandatory for all companies in India?

Yes — if they meet the applicability criteria for each benefit.

Q2: Can employers offer benefits beyond statutory requirements?

Yes — additional benefits can improve employee engagement and retention.

Q3: What happens if a company fails to provide statutory benefits?

They may face legal penalties, fines, and reputational damage.

Q4: Do statutory benefits apply to contract workers?

Yes — if they meet eligibility under respective laws.